In this tutorial we will discuss how to use the call activity in your business process. We will cover the following points:

- Difference between ‘Call-Activity’, and ‘Sub-process’.

- Example using the ‘Call Activity’.

Note: This tutorial is valid for webMethods versions 8.X to 9.X. You need to be familiar with webMethods business process familiar.

If you are not familiar with developing a business process with webMethods, please read the article on the following link:

webMethods Business Process Management (BPM) – Getting started

1. Difference between ‘Call-Activity’, and ‘Sub-process’.

Call Activity: it a step in a business process which invoke an existing ‘callable’ business process model. The business process which uses the call activity is called ‘Parent process’, and the called process is called ‘Child process’.

‘Sub-process’: is a block/group of steps in the business process, it is used to make reading the model easier, or repeat the sub-process in a loop.

So the difference is that the ‘Call activity’ can be used in more than one model to perform a specific functionality, but ‘Sub-process’ is used inside one business process, and it can’t be used in another model because it is simply a group of steps in a model.

2. Example using ‘Call Activity’

objective: develop a business process for a bank to issue a new credit card. The process will:

- Validate if the customer already exists in the bank system or not.

- If the customer doesn’t have an account, the process will call another business process ‘createCustomer’ to create the user profile. The ‘CreateCustomer’ process should be available for future use by another business process.

- The business process will send the order to issue the credit card and send it to client.

So we are going to develop two business models:

- Create Customer (callable business process/ child business process),

- Credit card request (the parent business process)

Note: We will discuss the details related to creating the callable business process, and using the call activity. We will not discuss the details of the regular steps as we already explained it in our earlier tutorials.

1. ‘CreateCustomer’ business process

This process should be callable business process and it should follow the specification of BPMN 2.0 (Business Process Model and Notation) as the use webMethods business process is deprecated (we will discuss the BPMN 2.0 specification in future tutorials).

Here is the process model:

The differences between this process model and any other regular business process(webMethods business processes) are in the start, end step, and configuring the ‘Global Process Specifications’.

The process must start with a ‘non-start event’ step (the empty green circle), and it must ends with the ‘End’ step (the empty red circle).

The start, and End steps are for marking the starting point, and end point of the model only, that’s why there is no input or output document in the implementation tab.

The remaining steps are:

‘validateData’: is a service task to make sure that all the requires fields are present.

‘CreateCustomer’: is a service task responsible in creating the customer in the bank system, and it is called only if the validation result is ‘true’ (Valid=true).

‘PrepareOutputDoc’: is a service task which is responsible to map/construct the final output document which will be passed to parent/caller model. The join type on this step ‘Un-Synchronized OR ’ which means it will be executed if only one of the conditions was true (Valid= true, or valid != true).

The last and important step is configuring the ‘Global Process Specifications’. Click anywhere outside of the process pool of the process and you will find the business process properties in the property tab, choose the ‘Global Process Specifications’ as per the below image.

Add the document type of the input and output in the ‘Input/output specification for callable process’. This step is important for the following reasons:

a) The process engine will search for the output document type in the pipeline while terminating the process instance in the runtime to be returned to the parent/caller business process.

b) For the caller/parent business process the callable business process is like a service call and its input/output parameters are the parameters defined in the ‘Global Process Specifications’.

This model is ready, please deploy it to be able to use/call it from the parent business process in the next section.

2. ‘CreditCardRequest’ process

Which is responsible for checking if the customer is an existing customer or not. If it found that it is a new customer the process will call the callable business process ‘CreateCustomer, then it issues the credit card for the customer.

The process is a regular business process following the rules we discussed in our earlier tutorials. The new is the use of the call activity to call another business process ‘CreateCustomer’ as a step in the business process. From the palette choose the ‘Call Activity’.

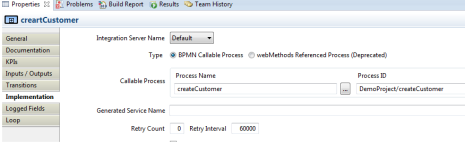

Click on the call activity step in your model to configure the business process to be called in the ‘properties > Implementation’ tab.

We will choose the type ‘BPMN callable process’, and we will press the ‘…’ button to choose the business process.

Note: You have to compile/deploy the callable business process (createCustomer)to be able to choose it.

If you go to the inputs/outputs parameters of the ‘Call activity’ step you will find the parameters of the callable business process which were defined in the ‘Process Global Specifications’.

Please deploy the process after finishing the development of the other steps (validation service, choosing the subscription document for the parent process, …)

Note: In the run time you will find one instance for the parent model(CreditCardRequest), and another one for the child model (createCustomer) in myWebmethods.

We hope that you find what you are looking for in our tutorial, and we are looking forward reading your comments and questions.

Follow us:

on twitter: @WM_Expert

Group on LinkedIn: webmethodsExpert.com

(C) 2015 Hossam Elsharkawy. All rights reserved.